Application for Social Insurance Management

The social insurance is the right deserved by every citizen, yet its managerial vulnerability is used for illegal profits from time to time. The cases of pension collection after beneficiary’s demise occur every year and the loss of social insurance fund amounts to hundreds of millions RMB in each province due to late or concealed death report of the retired, according to the responsible officers of the provinces. To prevent such situation and strengthen the management of social insurance fund, the Face Recognition & Verification System is gradually applied in all provinces and cities.

The Face Recognition & Verification System applied to Inner Mongolia social insurance is a dynamic recognition technology with better operation flexibility. Unlike fingerprint recognition technology, it doesn’t require for much cooperation of the pensioners, who are requested to take a photo shot at the social insurance center for one time only for features extraction by computer video image and filing in database. The pensions can be claimed when the pensioners’ faces are matched with the database locally or remotely. The innovative use of the advanced Face Recognition & Verification System in Inner Mongolia effectively resolved the problem of false pension claim which has long perplexed the authorities of various regions.

Management of Retirement Pension Payment

Biometrics can be applied in the retirement pension payment management by the government to combat pension fraud while provide the retired with efficient service. Retirement pension fraud is not uncommon in every country. This normally happens by concealing the death information so that the family member(s) of the dead could receive pension long after the death.

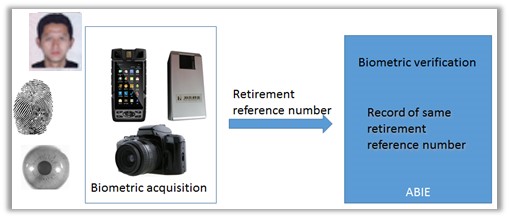

• Retirement Registration

A database of the retired people shall be set up for the management of the retirement pension payment. There two options for the biometric information storage of the retired people, one of which is to store the biometric data in the retirement record list in the management system, and an ABIE for this system is setup altogether; and the other option is to keep a reference link in the record or every retired person in the pension management system to the corresponding record of the person in the national ID Database. The latter is a cost effective solution and fully reflect the powerful and versatile usage of the national ID ABIE.

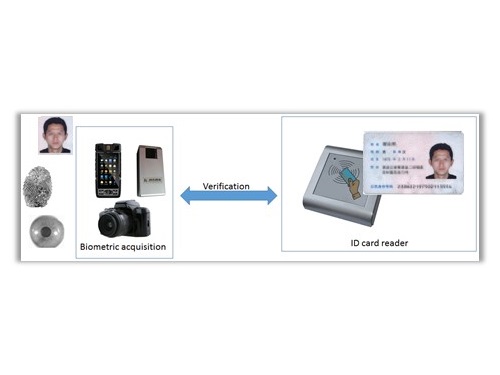

• Verification of Retired People Each Year or within Specified Time Interval

In order to prevent pension fraud, the retired people shall be checked once every year or within every specified time interval and the database for pension payment management be updated accordingly.

If the management system is setup with an ABIE for its own application, then the biometrics collected from a retired person shall be matched with the record of his/her retirement reference number in the database for verification.

For the second option mentioned above, the ID card of the retired person shall be verified and the record in the pension management database corresponding the ID number shall be updated according to the verification result.

related Hisign products:

Finger/palm print acquisition device

Handheld Biometric Verification Devices